- #TAXACT VS TURBOTAX PRICING UPGRADE#

- #TAXACT VS TURBOTAX PRICING SOFTWARE#

- #TAXACT VS TURBOTAX PRICING PLUS#

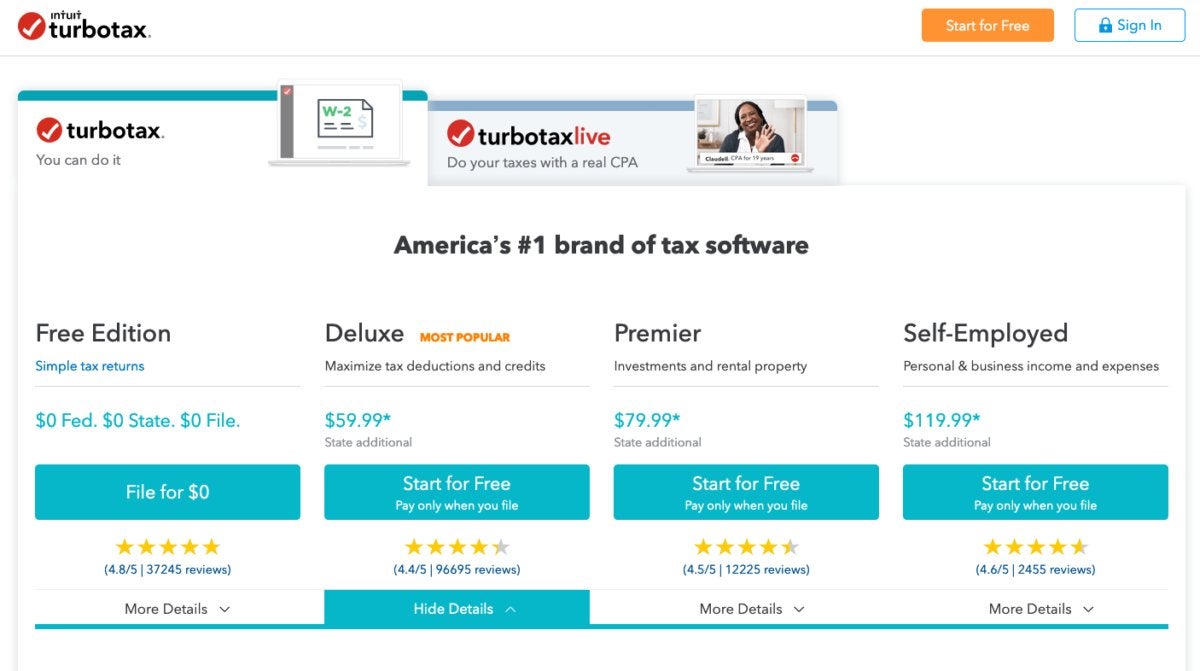

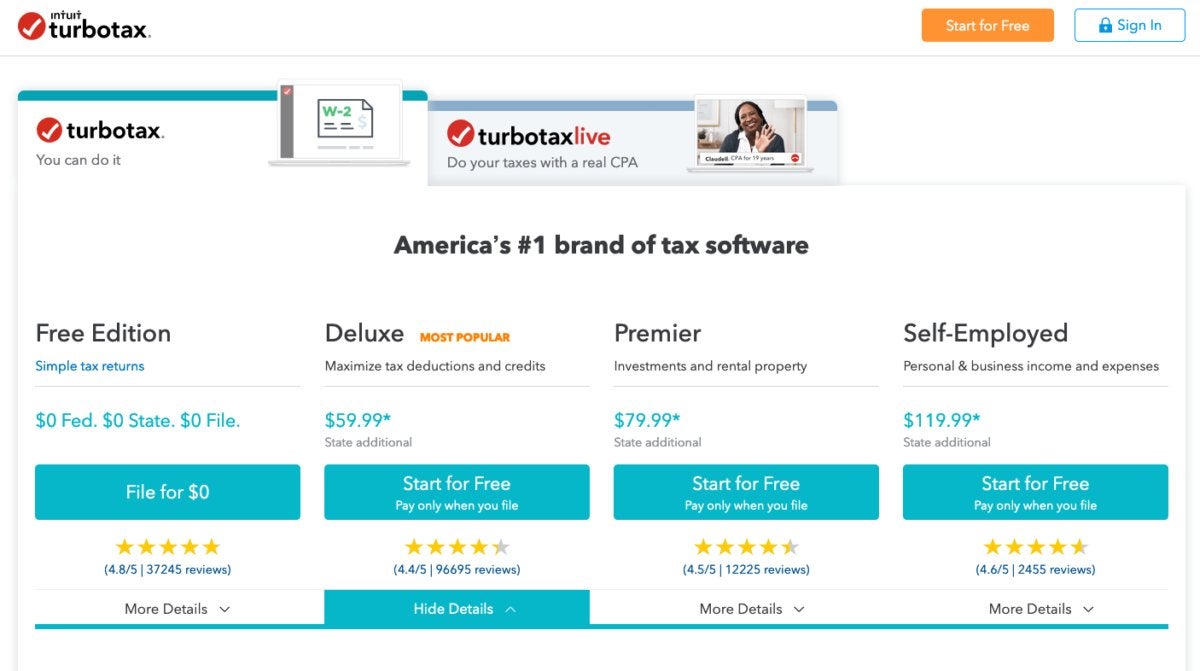

This package is built for those with investment income, rental property income, and foreign bank accounts. The Deluxe package allows you to file for those childcare expense credits, along with credits and deductions for homeowners, health savings account owners, and those who are currently paying student-loan interest. Credits for childcare expenses aren't included. You can use this plan if you are paid through W-2s or collected unemployment income, and want to claim basic child tax credits and the earned income tax credit (EITC). $44.95 with the Deluxe, Premier, and Self Employed versionsĬost of DIY Options and What They Cover.

Some competitors like H&R Block and TurboTax have done this for years, but charge extra. TaxAct also offers personalized support from tax experts at no additional cost through a program called Xpert Assist, which applies to all plan levels. Payment is due when it's time to file, so if you're not happy with your experience or refund calculation and decide to abandon your return, you won't owe TaxAct anything.

#TAXACT VS TURBOTAX PRICING SOFTWARE#

TaxAct's formula is similar to that of many other tax-filing software companies: You pay one price for a federal tax return, and an additional price for a state tax return. You can check the company's website to see current offers. The prices listed in this article do not include any discounts. Tax prep companies frequently offer discounts on products early in the season.

Need to file multiple state returns at an affordable cost. Want detailed explanations and guidance within the software itself. You Might Not Like Filing With TaxAct if You: #TAXACT VS TURBOTAX PRICING UPGRADE#

Want free expert help, or the option to upgrade and have a professional file your taxes. Find TurboTax's and H&R Block's extra features distracting or overwhelming. Appreciate time-saving features like document upload or import. You Might Like Filing With TaxAct if You: If you're willing to pay more for this time-saving feature, TaxAct could be worth it. TaxAct is not as inexpensive as TaxSlayer, but its tax document upload and import features have a better track record of working well than TaxSlayer's do. You also have the option to upgrade and have a professional file your taxes. However, all of TaxAct's plans also offer free access to experts to answer questions during the filing process, which is a huge value-add that started last year. TaxAct is best for people who don't want to pay for high-end software like H&R Block or TurboTax, but are still willing to pay a premium for an efficient and streamlined interface to file their own taxes.įilers who don't require much hand-holding will get the most out of the TaxAct software alone. W-2 income unemployment income retirement distributions tuition and fees deduction earned income tax credit child tax credit stimulus credit Option to have a professional file your taxes at an additional cost. Good middle-of-the road option on price and efficiency. Free, instant access to a tax expert at all plan levels. 4 plans, including a free federal option. It's best for someone who appreciates a simple, streamlined interface. TaxAct gets the job done with fewer bells and whistles than H&R Block or TurboTax, though costs can still add up. Most people are looking for a way to file that involves the least friction and low fees. In the years where I get a refund, I find myself celebrating every last penny of the "extra" cash.īut most people don't take joy in filing their taxes. In the years I owe, I find myself grateful for the abundance of the past year as I input each number into my tax filing software. I'm a personal finance nerd who looks forward to filing their taxes every year. See Personal Finance Insider's picks for the best tax software. #TAXACT VS TURBOTAX PRICING PLUS#

Updates this year include free expert access at all price points, plus the option to pay more to have an expert file for you.

TaxAct's interface isn't as detailed as some of its higher-end competitors, but it is easy to use.TaxAct offers four tax-filing plans, including a free federal option for basic tax situations.In some cases, we receive a commission from our partners however, our opinions are our own. Our experts answer readers' tax questions and write unbiased product reviews ( here's how we assess tax products).

0 kommentar(er)

0 kommentar(er)